39 advantage of zero coupon bonds

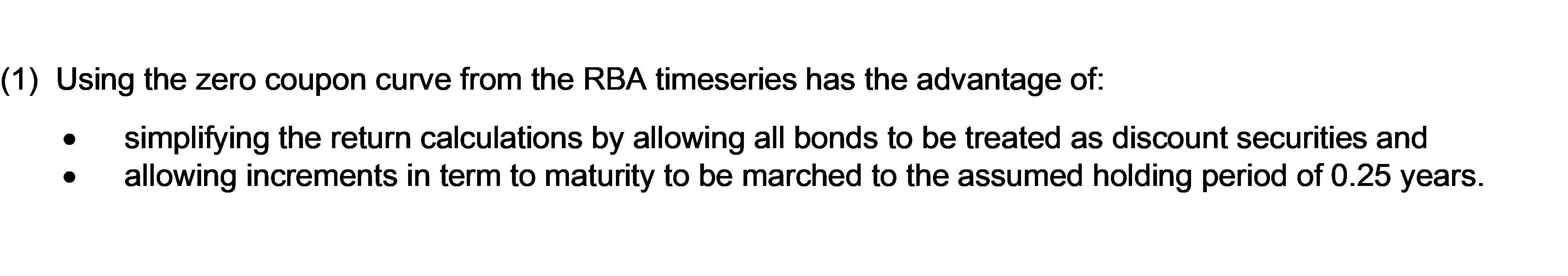

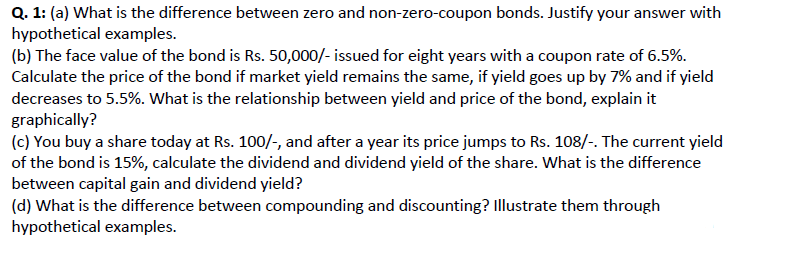

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity ... Warrant (finance) - Wikipedia This warrant is company-issued. Suppose, a mutual fund that holds shares of the company sells warrants against those shares, also exercisable at $500 per share. These are called third-party warrants. The primary advantage is that the instrument helps in the price discovery process. In the above case, the mutual fund selling a one-year warrant ...

Understanding Bonds: The Types & Risks of Bond Investments Because bonds tend not to move in tandem with stock investments, they help provide diversification in an investor's portfolio. They also provide investors with a steady income stream, usually at a higher rate than money market investments Footnote 1. Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and …

Advantage of zero coupon bonds

How to Invest in Bonds in October 2022 Sep 12, 2022 · Municipal bonds offer an ethical advantage too. Investing in a municipal bond means lending your local authority money to complete a project, whilst securing a fixed income for yourself too. 3 ... Government Bonds India - Types, Advantages and Disadvantages … Zero-Coupon Bonds. As the name suggests, Zero-Coupon Bonds do not earn any interest. Earnings from Zero-Coupon Bonds arise from the difference in issuance price (at a discount) and redemption value (at par). This type of bonds are not issued through auction but rather created from existing securities. Advantages of Investing in Government Bonds? Advantages and Risks of Zero Coupon Treasury Bonds 31.01.2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Advantage of zero coupon bonds. How Are Municipal Bonds Taxed? - Investopedia 17.01.2022 · Zero-coupon municipal bonds, which are bought at a discount because they do not make any interest or coupon payments, don’t have to be taxed. In fact, most aren't. As long as you’re investing ... Corporate Bonds - Fidelity Zero-coupon Zero-coupon corporate bonds are issued at a discount from face value (par), with the full value, including imputed interest, paid at maturity. Interest is taxable, even though no actual payments are made. Prices of zero-coupon bonds tend to be more volatile than bonds that make regular interest payments. Callable and puttable Government Bonds: Types, Benefits & How to Buy Government Bonds Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction. Features of Government Bonds. SEE … Advantages and Risks of Zero Coupon Treasury Bonds 31.01.2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Government Bonds India - Types, Advantages and Disadvantages … Zero-Coupon Bonds. As the name suggests, Zero-Coupon Bonds do not earn any interest. Earnings from Zero-Coupon Bonds arise from the difference in issuance price (at a discount) and redemption value (at par). This type of bonds are not issued through auction but rather created from existing securities. Advantages of Investing in Government Bonds? How to Invest in Bonds in October 2022 Sep 12, 2022 · Municipal bonds offer an ethical advantage too. Investing in a municipal bond means lending your local authority money to complete a project, whilst securing a fixed income for yourself too. 3 ...

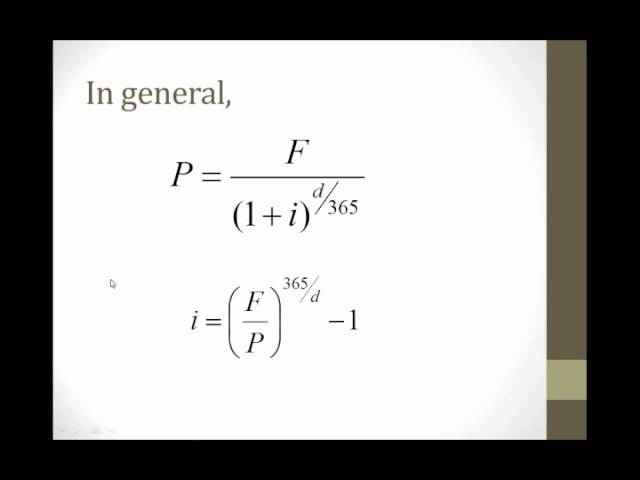

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc():gifv()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)

Post a Comment for "39 advantage of zero coupon bonds"