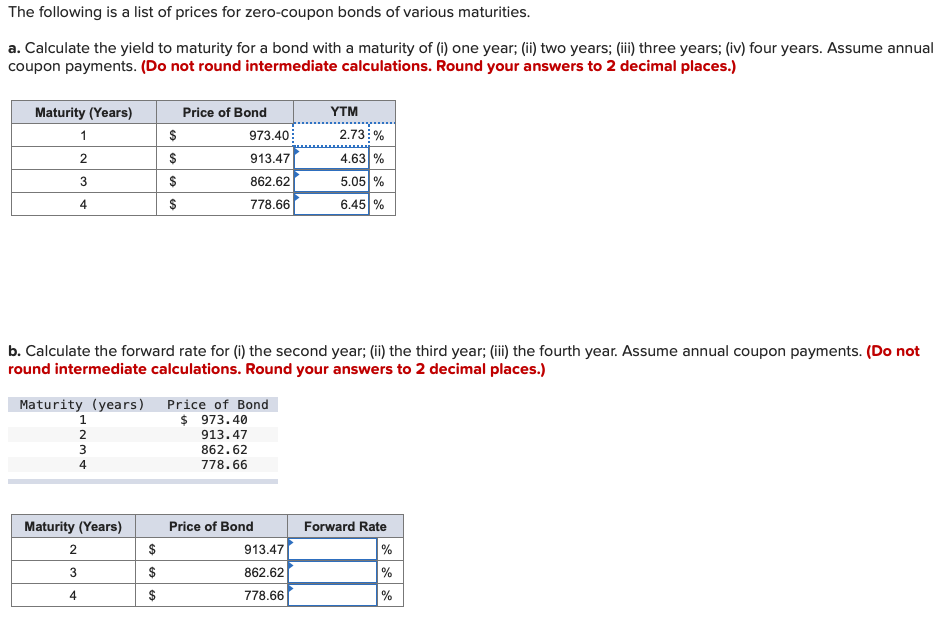

39 zero coupon bond yield calculation

Investing in Bonds Part II | Moneyzine.com Part II of a multipart series on investing in bonds, this article focuses on bond terminology, as well as the process for calculating bond yields. My Money Financial Planning en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows.

Pakistan Government Bonds - Yields Curve The Pakistan 10Y Government Bond has a 13.163% yield. Click on Spread value for the historical serie. A positive spread, marked by , means that the 10Y Bond Yield is higher than the corresponding foreign bond. Instead, a negative spread is marked by a green circle.

Zero coupon bond yield calculation

Understanding the Different Types of Bond Yields - Investopedia Yield to call simply refers to the bond's yield at the time of its call date. This value doesn't hold if the bond is kept until maturity, but only describes the value at the call date, which if... Bonds of Mass Destruction - The Last Bear Standing Let's look at the price instead. This particular bond was issued in October 2020 with a coupon of 0.50%. Allegedly sane, sophisticated investors lent the U.K. government money at a fixed rate of 0.50% for forty years. While this sounds like a boring investment, it is an extraordinarily risky bet on interest rates. Question about Zero-Coupon Bond - BrainMass A 20-year, $1,000 par value zero-coupon rate bond is to be issued to yield 11 percent a. What should be the initial price of the bond? (Take the present value of 1000 for 20 years, using Appendix B at the back of the text.) b. If immediately upon issue, interest rates dropped to 9 percent, what would be the value of the zero-coupon rate bond? c.

Zero coupon bond yield calculation. What Is Bond Yield? - Investopedia 31/05/2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... › zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Kenya Government Bonds - Yields Curve The Kenya 10Y Government Bond has a 14.296% yield. Click on Spread value for the historical serie. A positive spread, marked by , means that the 10Y Bond Yield is higher than the corresponding foreign bond. Instead, a negative spread is marked by a green circle. dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Current Yield | Moneyzine.com Calculation Current Yield (%) = (Annual Payments / Market Price) x 100 Where: Annual Payments are equal to the total of all the bond or dividend payments received over the next twelve months. Market Price is the current market price of the security; not the price when the security is first issued or purchased by the investor. Explanation › terms › bWhat Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... › coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) It calculates bond yield by using the bond's settlement value, maturity, rate, price, and bond redemption. read more of a bond, the denominator is the market price of the bond. The coupon rate is fixed for the entire duration of the bond as both the numerator and the denominator for the calculation of the coupon rate do not change. Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31/05/2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Zero Coupon Yield Curve - The Thai Bond Market Association Average bidding yields of 1-month, 3-month, 6-month and 1-year T-bills are bond equivalent yield converted from average simple yields. 3. Spreads (bp) are differences bid and offer yields. How Can I Create a Yield Curve in Excel? - Investopedia 5 Steps to Calculating Yield Curve Using Microsoft Excel, enter "U.S. Treasury Bonds' Times to Maturity" in cell A1 and "U.S. Treasury Bond's Yields to Maturity" in cell B1. Next, enter "2" into... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total … Quant Bonds - Between Coupon Dates - BetterSolutions.com Quant Bonds - Between Coupon Dates Yield Between Coupon Dates There are several ways you can calculate the yield to maturity for dates that fall between coupon dates: 1) Using the IRR function 2) Using the YIELD function 3) Using the XIRR function 4) Using the Secant Method 5) Using the Bisection Method 6) Using the Newton Raphson Assumptions

EOF

› EN › MarketZero Coupon Yield Curve - The Thai Bond Market Association IRR Calculation; Bond Price. Search by Bond; Month-end MTM Prices; ... Bond Market Data; Yield Curve; Zero Coupon Yield Curve; Service Manager : Wat (0-2257-0357 ext ...

Quant Bonds - Asset Swap Spread - BetterSolutions.com Uses the Zero Coupon Yield curve By combining the two you can change the coupon payments to either fixed or floating. This is the yield of the bond minus the swap rate for the corresponding maturity swap A fixed-rate bond will be combined with an interest rate swap in which the bond holder pays a fixed coupon and receives a floating coupon.

Yield to Call Calculator | Calculating YTC | InvestingAnswers To calculate a bond's yield to call, you'll need to know the: face value (also known as "par value") coupon rate number of years to the call date frequency of payments call premium (if any) current price of the bond Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and an 8% coupon for $900.

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures.

Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, …

› financial › bond-yieldBond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below:

What Is Bond Duration? Definition, Formula & Examples The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is...

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Current yield - Wikipedia The current yield, interest yield, income yield, flat yield, market yield, mark to market yield or running yield is a financial term used in reference to bonds and other fixed-interest securities such as gilts.It is the ratio of the annual interest payment and the bond's price: =. According to Investopedia, the clean market price of the bond should be the denominator in this calculation.

Bond Yield Calculator - CalculateStuff.com We can start with the current yield calculation, as that will be a much easier task. To calculate current yield, we must know the annual cash inflow of the bond as well as the current market price. The bond pays out $21 every six months, so this means that the bond pays out $42 every year. The current market price of the bond is how much the ...

Zero Coupon Bond: Calculate the YTM (yield to maturity) - BrainMass 1. Step 1 Look at the value of the bond when it will reach maturity. We have a bond which will be worth $1000 in ten years. 2. Step 2 Check the price that you paid for the bond. We have $459. 3. Step 3 Subtract the number of years between the zero coupon bonds maturity ... Solution Summary

Question about Zero-Coupon Bond - BrainMass A 20-year, $1,000 par value zero-coupon rate bond is to be issued to yield 11 percent a. What should be the initial price of the bond? (Take the present value of 1000 for 20 years, using Appendix B at the back of the text.) b. If immediately upon issue, interest rates dropped to 9 percent, what would be the value of the zero-coupon rate bond? c.

Bonds of Mass Destruction - The Last Bear Standing Let's look at the price instead. This particular bond was issued in October 2020 with a coupon of 0.50%. Allegedly sane, sophisticated investors lent the U.K. government money at a fixed rate of 0.50% for forty years. While this sounds like a boring investment, it is an extraordinarily risky bet on interest rates.

Understanding the Different Types of Bond Yields - Investopedia Yield to call simply refers to the bond's yield at the time of its call date. This value doesn't hold if the bond is kept until maturity, but only describes the value at the call date, which if...

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "39 zero coupon bond yield calculation"