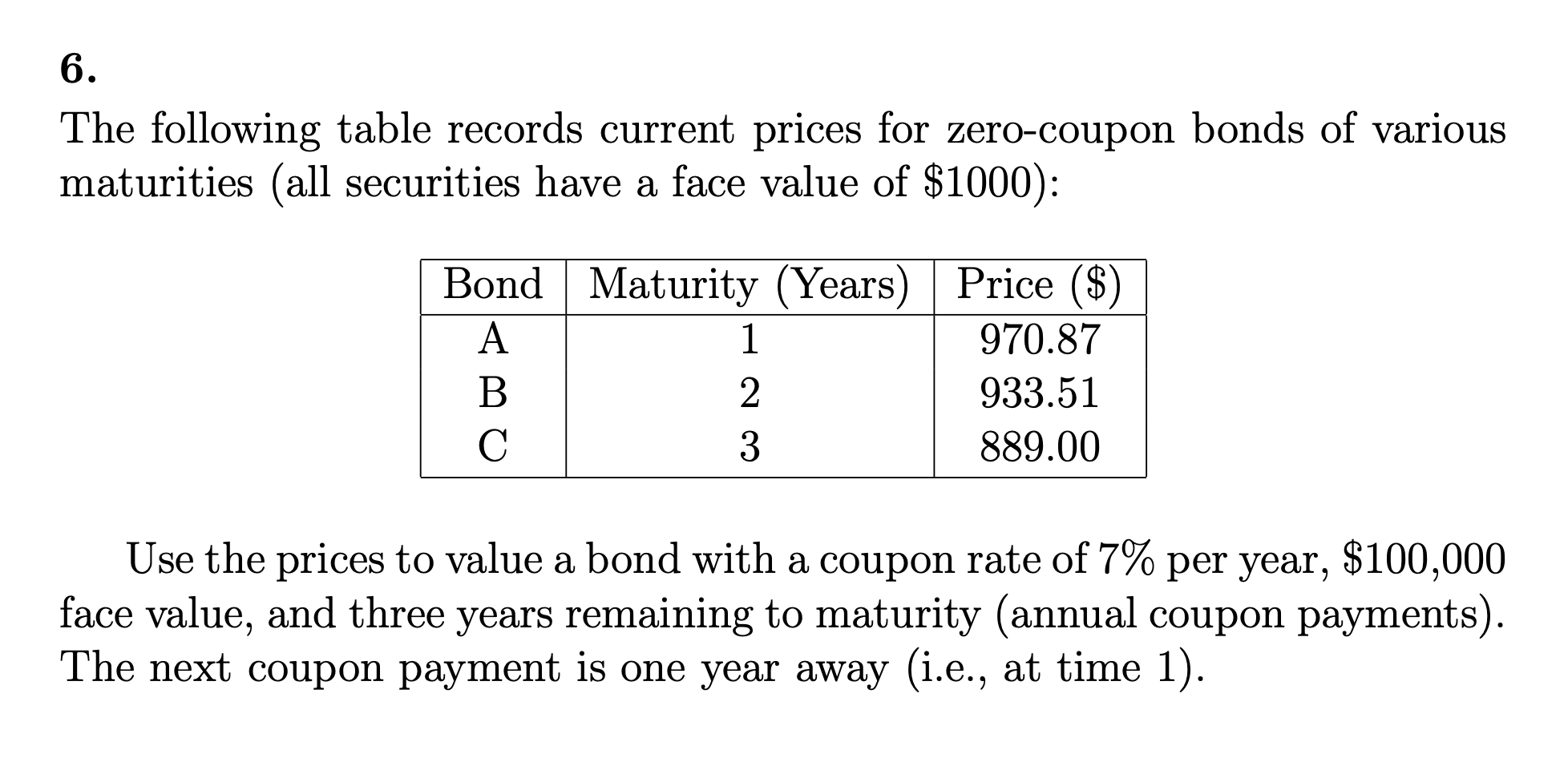

38 pricing zero coupon bonds

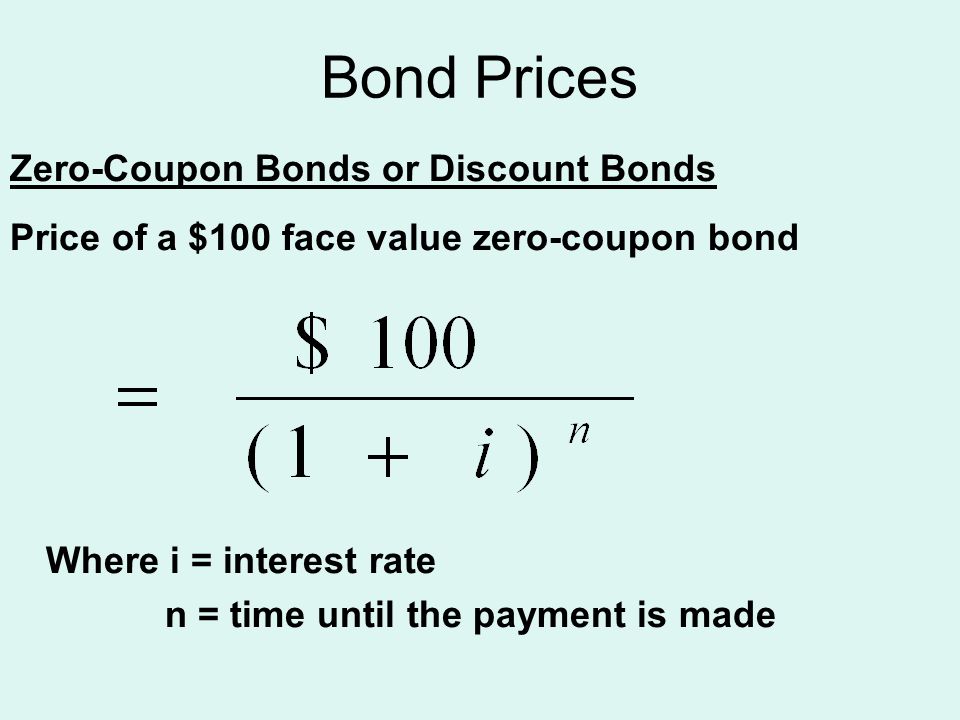

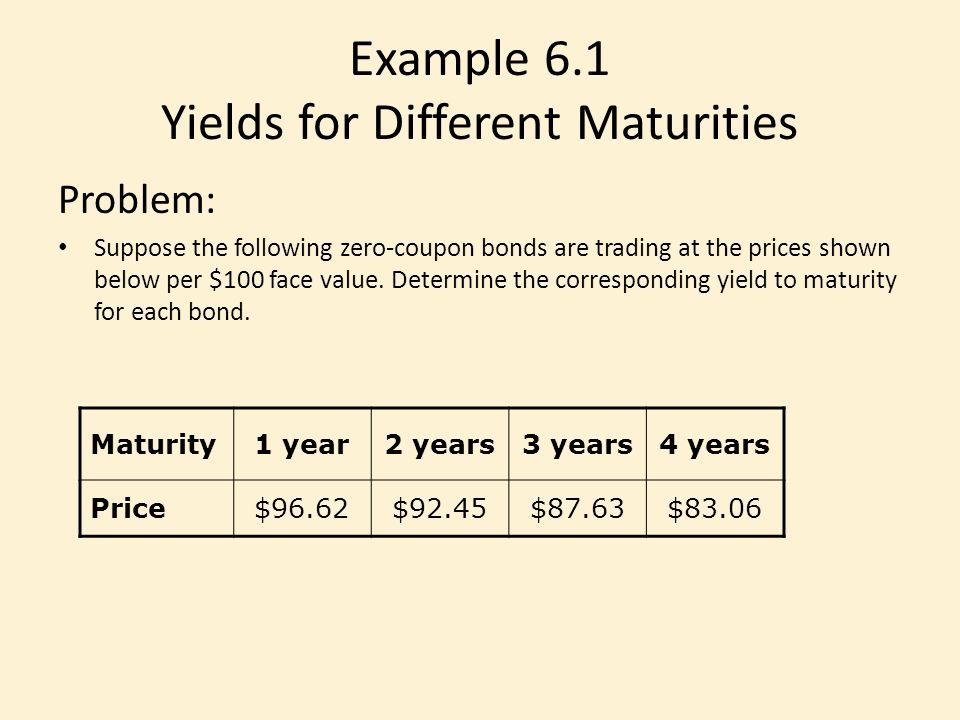

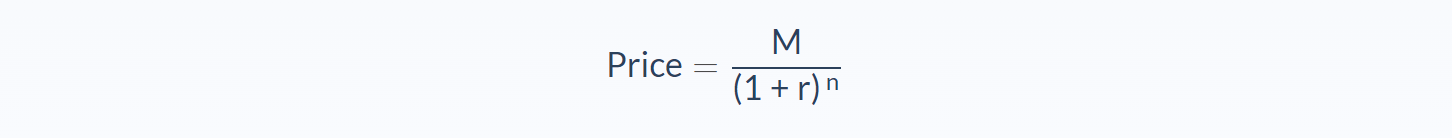

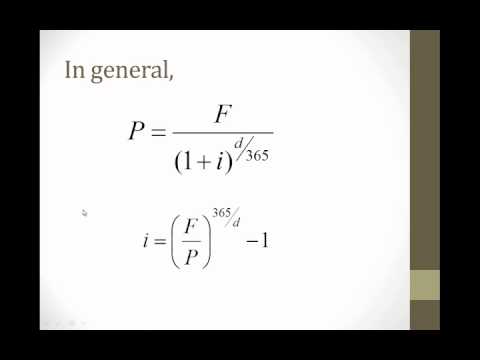

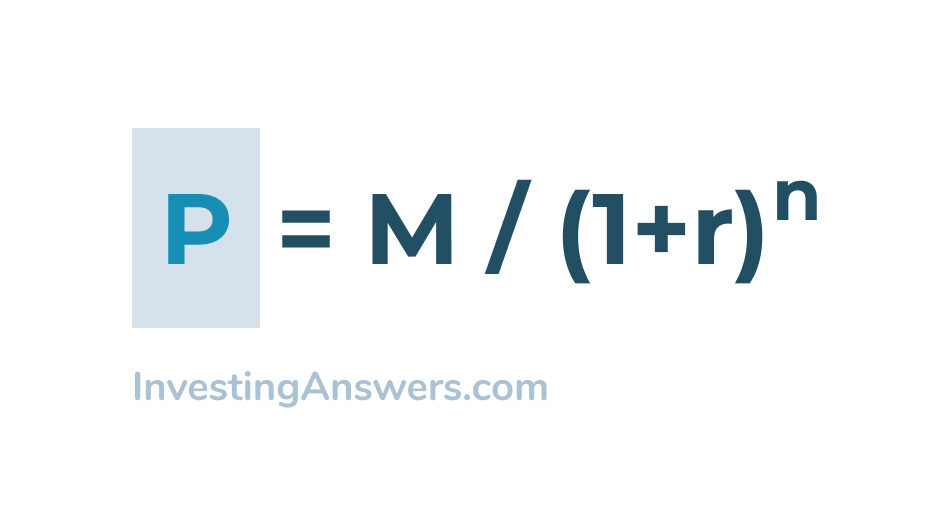

Zero Coupon Bond Definition and Example | Investing Answers Calculating the Price of a Zero Coupon Bond The price of a zero-coupon bond can be calculated by using the following formula: where: M = maturity (or face) value r = investor's required annual yield / 2 n = number of years until maturity x 2 P = Price Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... The price of zero-coupon bonds is calculated using the formula given below: See also How to Backtest Options Strategies? Best Tool You Can Use Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity

Pricing zero coupon bonds

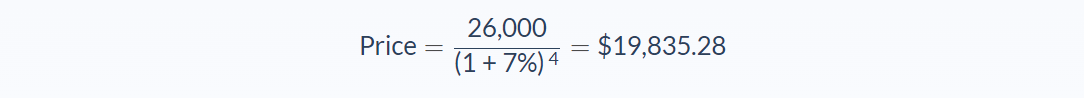

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Interest Rate Statistics | U.S. Department of the Treasury WebTo estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data The Zero Coupon Bond: Pricing and Charactertistics Calculating the Price of a Zero Coupon Bond The basic math is easy. What should an investor pay for the 1-year coupon? If the investor demands a 4% return over a one-year period, she should pay something around $96 for the $100 maturity value (actually $96.154 since we're starting at less than $100).

Pricing zero coupon bonds. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww The annually Zero Coupon Bond and the semi-annual Zero Coupon Bond can be measured using two simple formulas, which are mentioned below: Price of Zero Coupon Bond calculated annually Price of Zero Coupon Bond calculated semi-annually In both the formulas: Face value = Future value or maturity value of the bond Unbanked American households hit record low numbers in 2021 Web25.10.2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ... home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data How to Calculate the Price of a Zero Coupon Bond To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures.

Bond Pricing - Formula, How to Calculate a Bond's Price For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value Each bond must come with a par value that is repaid at maturity. United States Treasury security - Wikipedia WebTreasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these … Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Pricing of zero-coupon bond options - Big Chemical Encyclopedia Pricing of zero-coupon bond options. Starting from the risk-neutral bond price dynamics (5.4), we derive the well known closed-form solution for the price of a zero-coupon bond option. Thus, as shown in section (2.1) the price of a call option on a discount bond is given by [Pg.44] the abiUty to derive a closed-form of t z) crucially depends on ...

Zero-Coupon Bond: Definition, How It Works, and How To Calculate Web31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Microsoft takes the gloves off as it battles Sony for its Activision ... Web12.10.2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition. Zero Coupon Bond Calculator - Nerd Counter There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. So, the under the given procedure will be applied to have the demanded answer easily: $4000 (1+.3)20; $4000; 190.049637748; $21.05 Zero-Coupon Bond - Definition, How It Works, Formula Pricing Zero-Coupon Bonds To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

DIY Seo Software - Locustware.com WebDIY Seo Software From Locustware Is Exactly What You Need! Looking To Improve Your Website's Search Engine Optimization? No more guesswork - Rank On Demand

Achiever Papers - We help students improve their academic standing WebYou can have the privilege of paying part by part for long orders thus you can enjoy flexible pricing. We also give discounts for returned customers are we have returned customer discounts. We also give our clients the privilege of keeping track of the progress of their assignments. You can keep track of all your in-progress assignments. Having many years …

Bond: Financial Meaning With Examples and How They Are Priced Web01.07.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Mortgage-backed security - Wikipedia WebCovered bonds were first created in 19th-century Germany when Frankfurter Hypo began issuing mortgage covered bonds. The market has been regulated since the creation of a law governing the securities in Germany in 1900. The key difference between covered bonds and mortgage-backed or asset-backed securities is that banks that make loans …

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

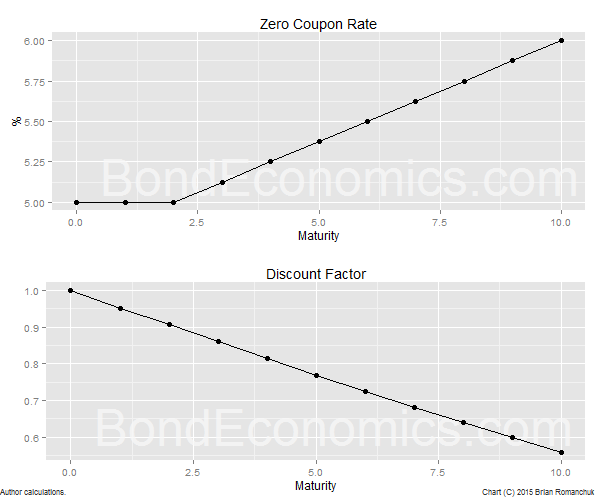

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation.

Understanding Bond Prices and Yields - Investopedia Web28.06.2007 · To understand discount versus premium pricing, remember that when you buy a bond, you buy them for the coupon payments. While different bonds make their coupon payments at different frequencies ...

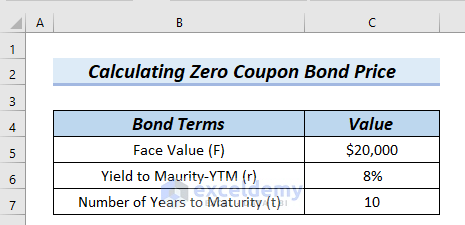

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. For this reason, zero-coupon bonds are often purchased to meet a future expense such as college costs or an anticipated expenditure in retirement.

How to Buy Zero Coupon Bonds | Finance - Zacks The less you pay for a zero coupon bond, the higher the yield. A bond with a face value of $1,000 purchased for $600 will yield $400 at maturity. Zero coupon bonds are issued by the...

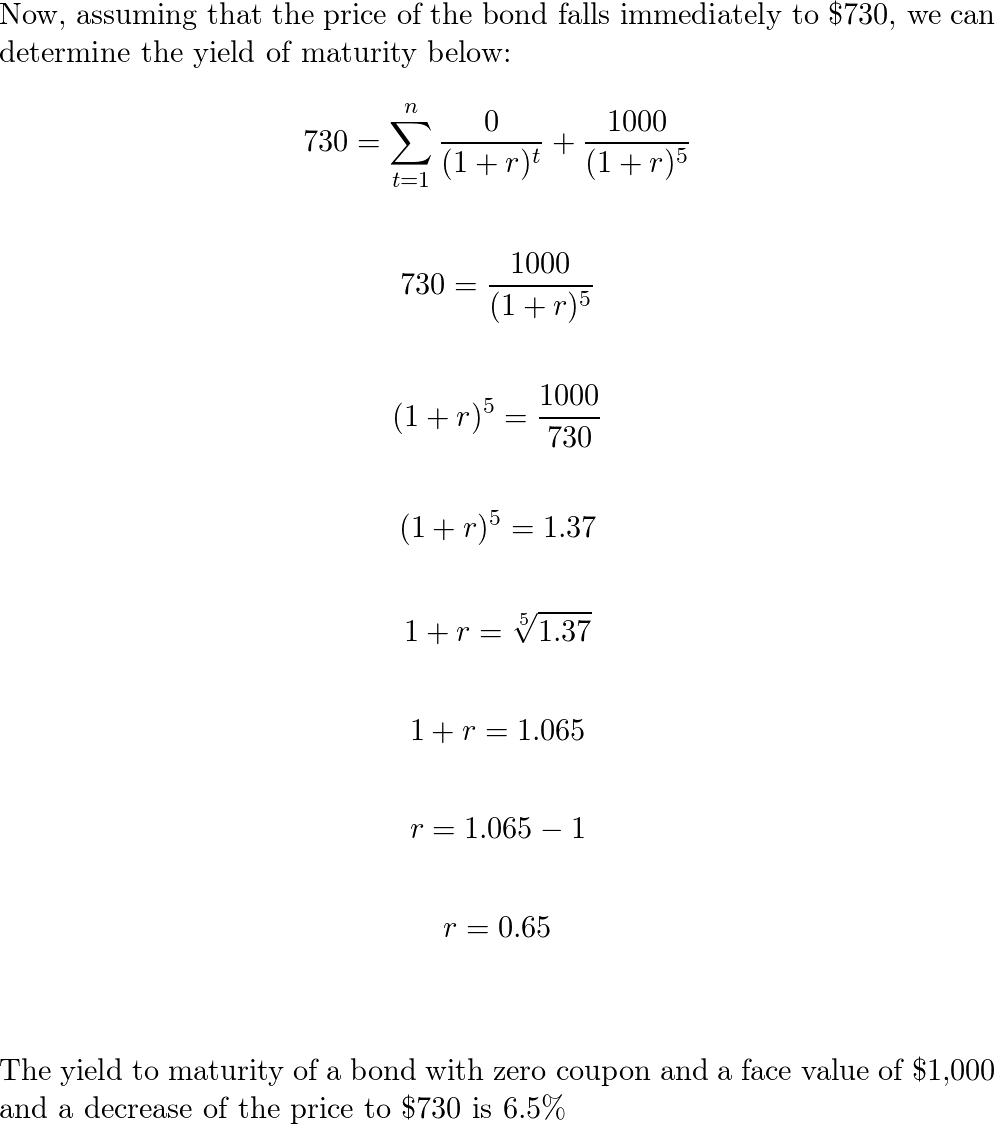

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

The Zero Coupon Bond: Pricing and Charactertistics Calculating the Price of a Zero Coupon Bond The basic math is easy. What should an investor pay for the 1-year coupon? If the investor demands a 4% return over a one-year period, she should pay something around $96 for the $100 maturity value (actually $96.154 since we're starting at less than $100).

Interest Rate Statistics | U.S. Department of the Treasury WebTo estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Post a Comment for "38 pricing zero coupon bonds"