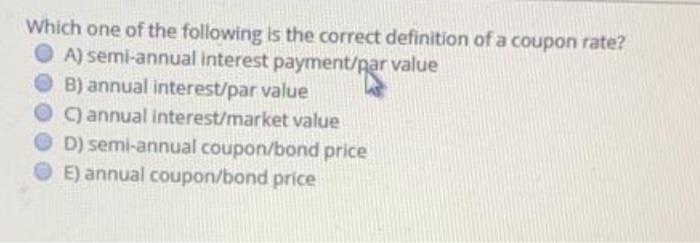

41 coupon interest rate definition

What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Coupon interest rate definition

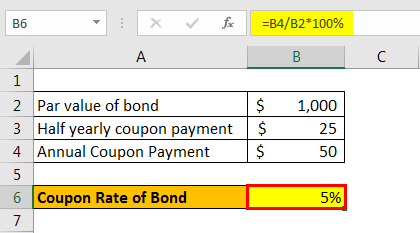

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The amount of interest is known as the coupon rate. Unlike other financial products, the dollar amount (and not the percentage) is fixed over time. For example, a bond with a face value of $1,000 and a 2% coupon rate pays $20 to the bondholder until its maturity. Even if the bond price rises or falls in value, the interest payments will remain ... Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower. Coupon rate - definition and meaning - Market Business News The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. In other words, from its issue date until it reaches maturity. Bonds are types of debts or IOUs that companies, municipalities, or governments sell and people buy.

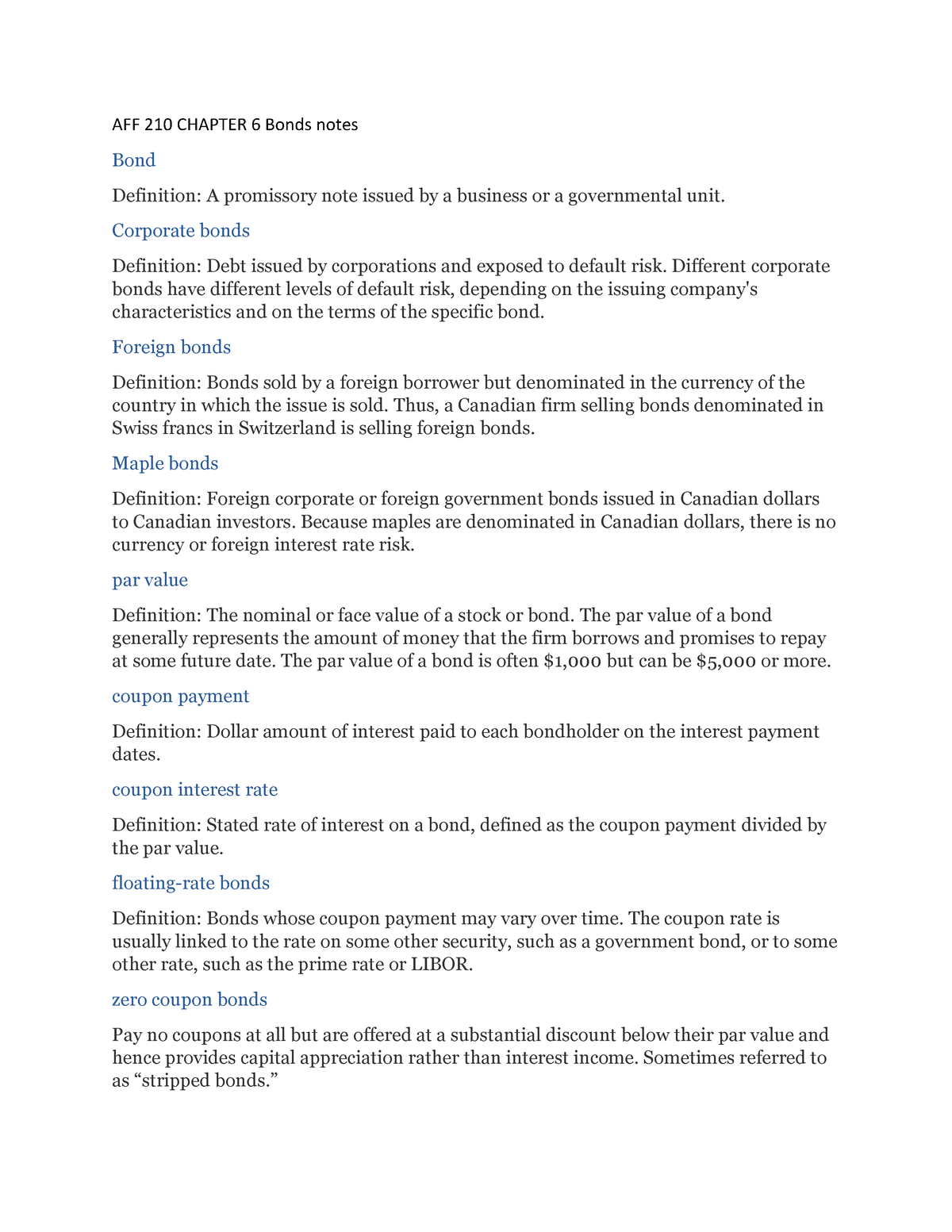

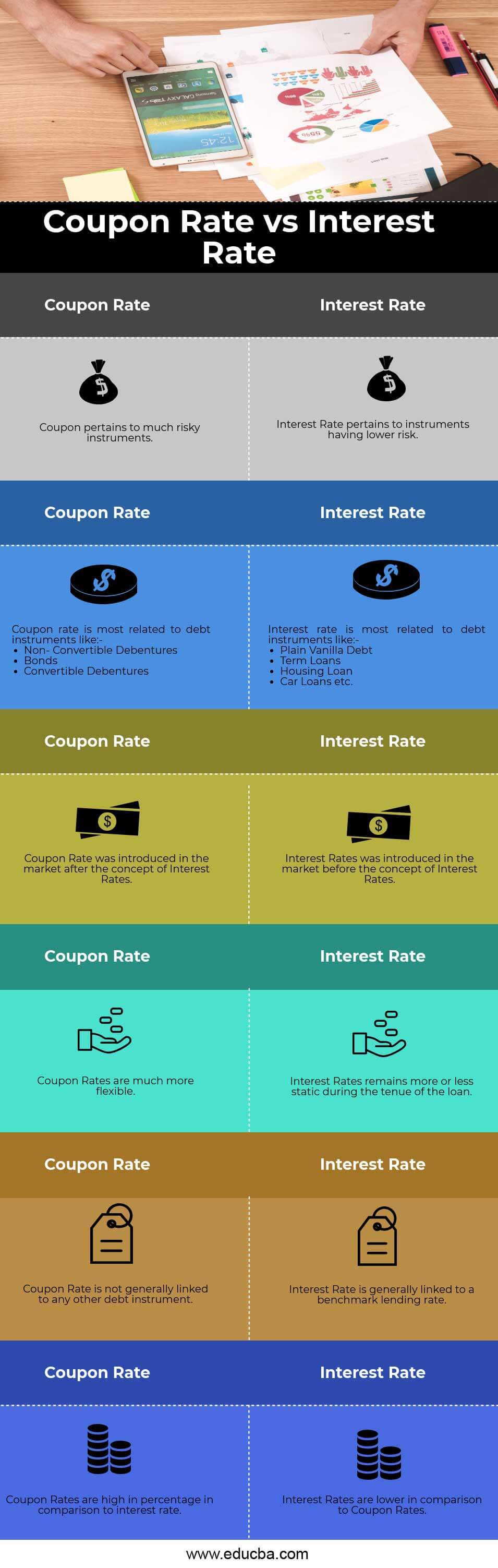

Coupon interest rate definition. Coupon Interest Rate Definition | Law Insider Coupon Interest Rate means the interest rate(expressed as a percentageper annum), as specifiedon the Australian Government Bonds Website, payablein respect ofa specificseriesof TreasuryIndexedBonds. Sample 1Sample 2 Based on 4 documents 4 Save Copy Remove Advertising Examples of Coupon Interest Ratein a sentence Difference Between Coupon Rate and Interest Rate A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Coupon Rate vs Interest Rate Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo What is Coupon Rate? The coupon rate is the rate of interest being paid off for the fixed income security such as bonds. This interest is paid by the bond issuers where it is being calculated annually on the bonds face value, and it is being paid to the purchasers. Coupon Interest Rate: What is Coupon Interest Rate? Fixed Income ... What is Coupon Interest Rate? The Interest to be annually paid by the issuer of a bond as a percent of per value, which is specifi

Difference Between Coupon Rate and Interest Rate • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender. Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. What Is a Certificate of Deposit Coupon? | Pocketsense A coupon is the stated rate of interest on the certificate of deposit. The term comes from bonds that have coupons that must be torn off the original bond and redeemed to be paid the interest due. The interest rate specified by the coupon is paid at set intervals.

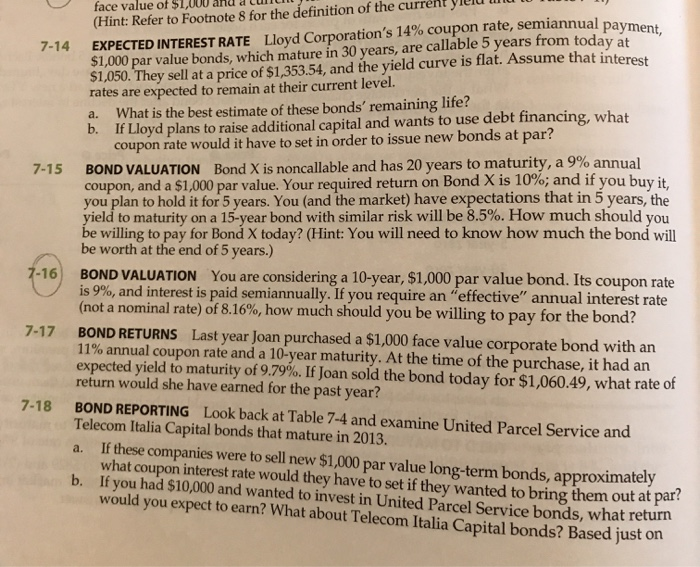

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ... Coupon rate - definition and meaning - Market Business News The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. In other words, from its issue date until it reaches maturity. Bonds are types of debts or IOUs that companies, municipalities, or governments sell and people buy. Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The amount of interest is known as the coupon rate. Unlike other financial products, the dollar amount (and not the percentage) is fixed over time. For example, a bond with a face value of $1,000 and a 2% coupon rate pays $20 to the bondholder until its maturity. Even if the bond price rises or falls in value, the interest payments will remain ...

:max_bytes(150000):strip_icc()/interest-rates-1d0e17952d9949b1bab273e830855f90.png)

Post a Comment for "41 coupon interest rate definition"