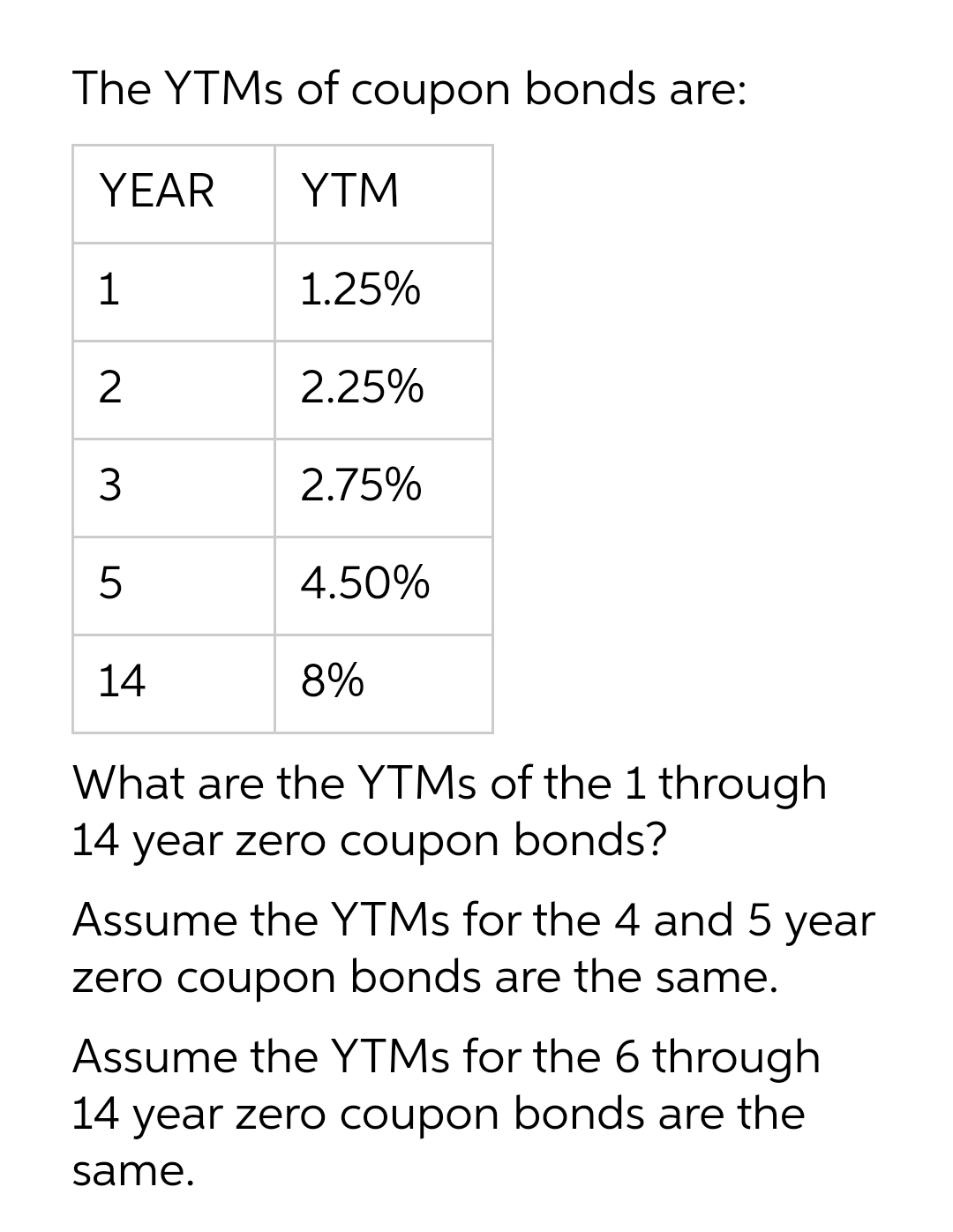

41 ytm for zero coupon bond

Ytm for zero coupon bond 2021 - siapakamu.vercel.app Zero Coupon Bonds - Financial Edge Training. Transcribed Image Text from this QuestionThe yield to maturity YTM on 1-year zero-coupon bonds is 7 and the YTM on 2-year zeros is 8. You can compare YTM between various debt issues to see which ones would perform best. Zero Coupon Bond Yield Calculator - YTM of a discount bond. Ytm Calculator For Zero Coupon Bond - thereviewstudio.com Ytm calculator for zero coupon bond. I was a Direct TV customer for 12 years and left because customer service was so poor. Find the full terms and conditions on the wireless home phone terms page. The prayers ringing out across the city which are a backdrop to our lives here sounded more poignant. We've always liked Apple's Retina display ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Ytm for zero coupon bond

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding What is a Zero Coupon Bond? Who Should Invest? | Scripbox The price of a zero coupon bond is calculated using the YTM formula. If the above formula is rearranged to calculate for the price, then the market price of the bond will be: Present value = ( Face value /(1+YTM)^n) - 1

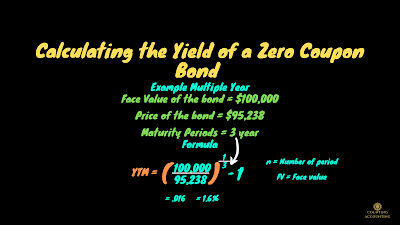

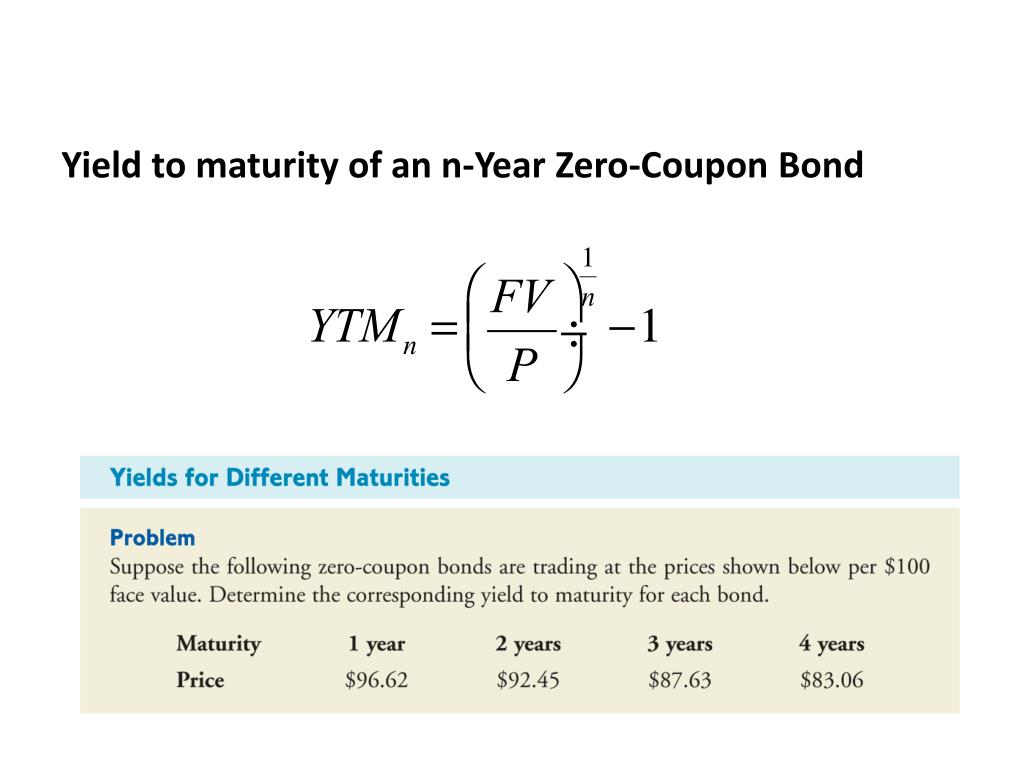

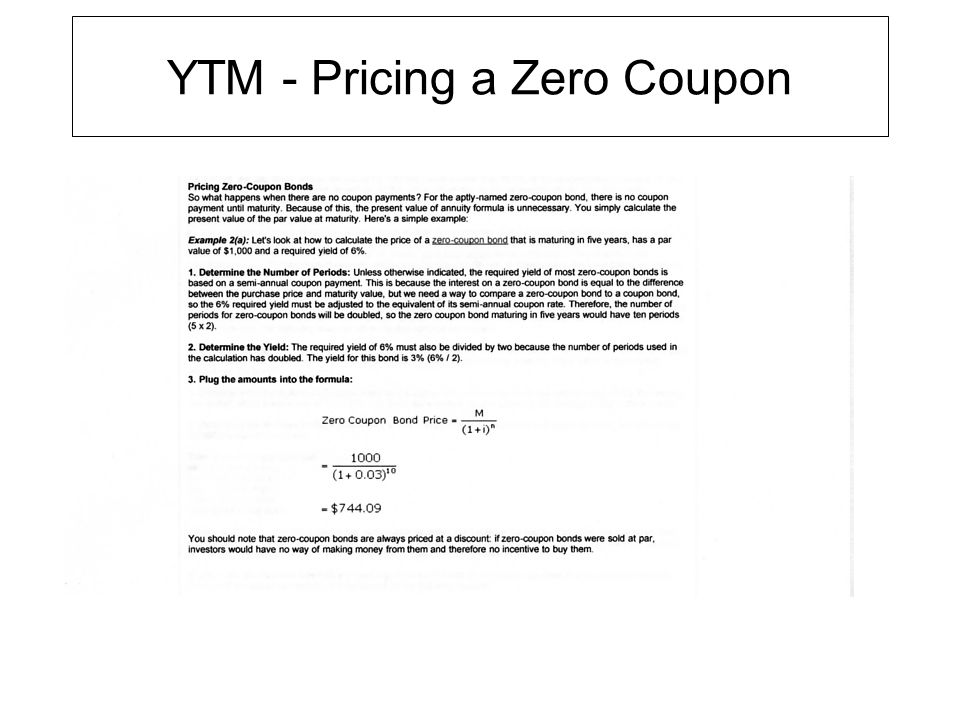

Ytm for zero coupon bond. Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. This calculator can be used to calculate the effective annual ... Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased... Zero Coupon Bonds - Financial Edge Here is an example of calculating YTM. A zero coupon bond with a par value of 725 is paying 1,000 after 3 years. What is the expected yield to maturity on this bond? (1/3)-1 = 11.3%. The bondholder expects a return of 11.3%. Share this article. Test Yourself. FREE DOWNLOAD.

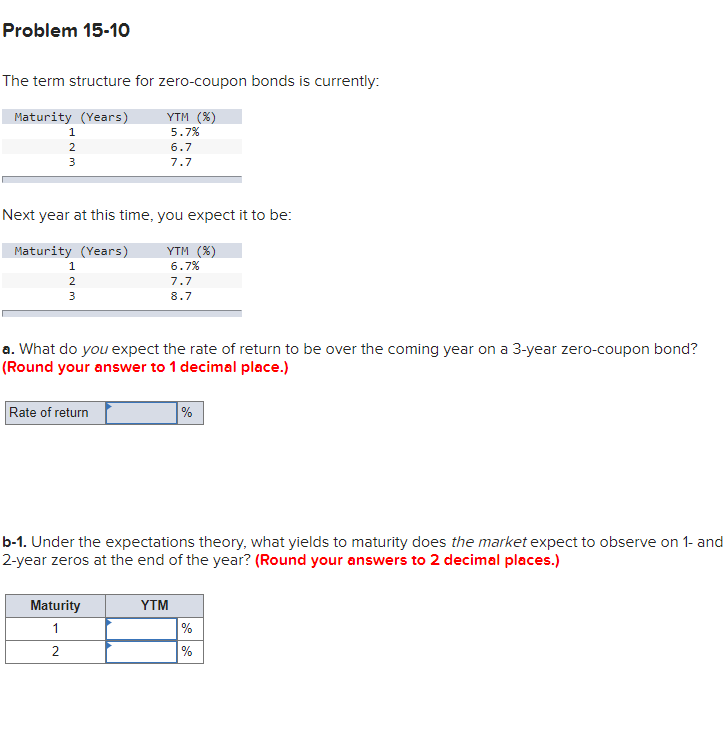

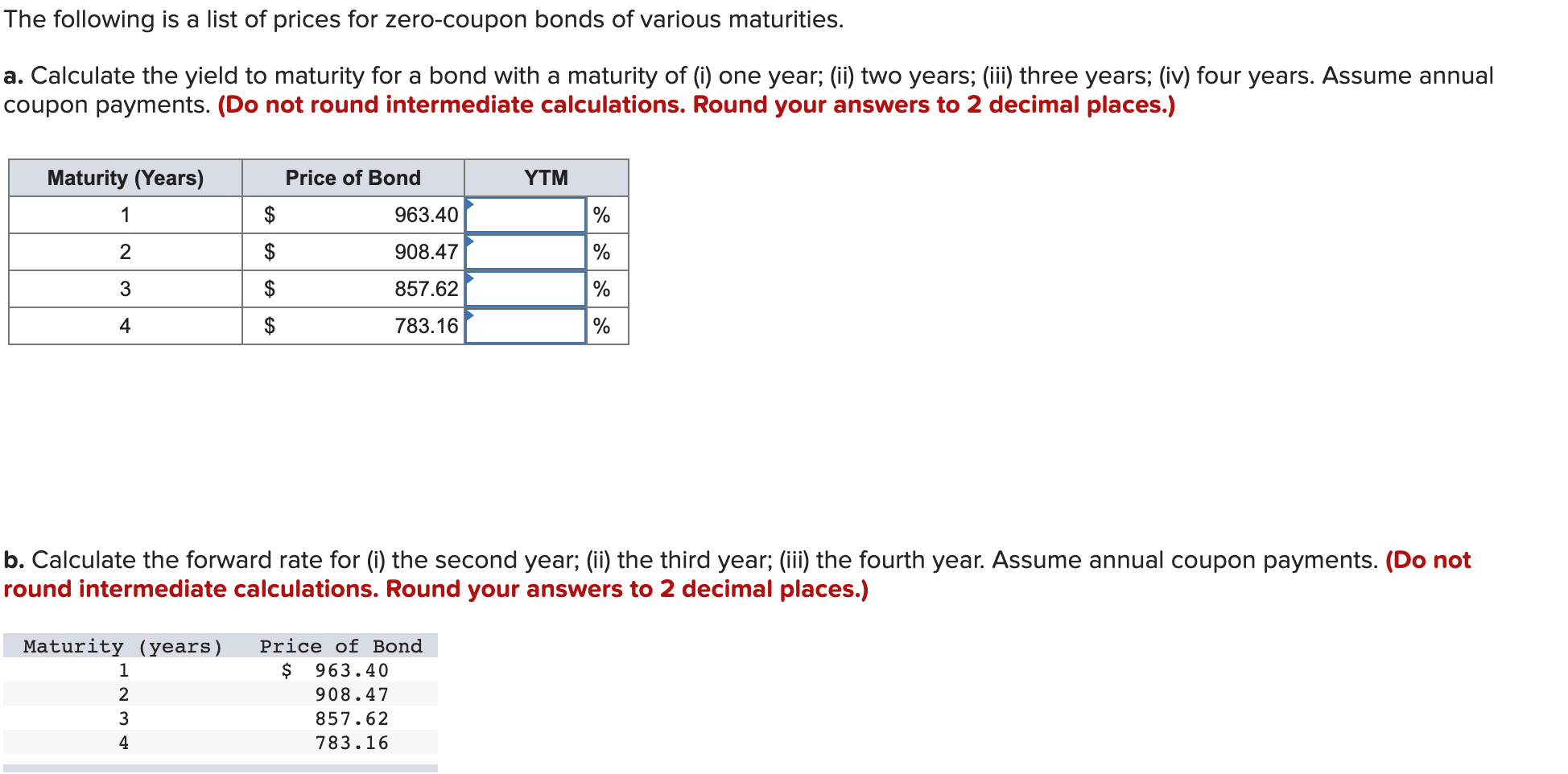

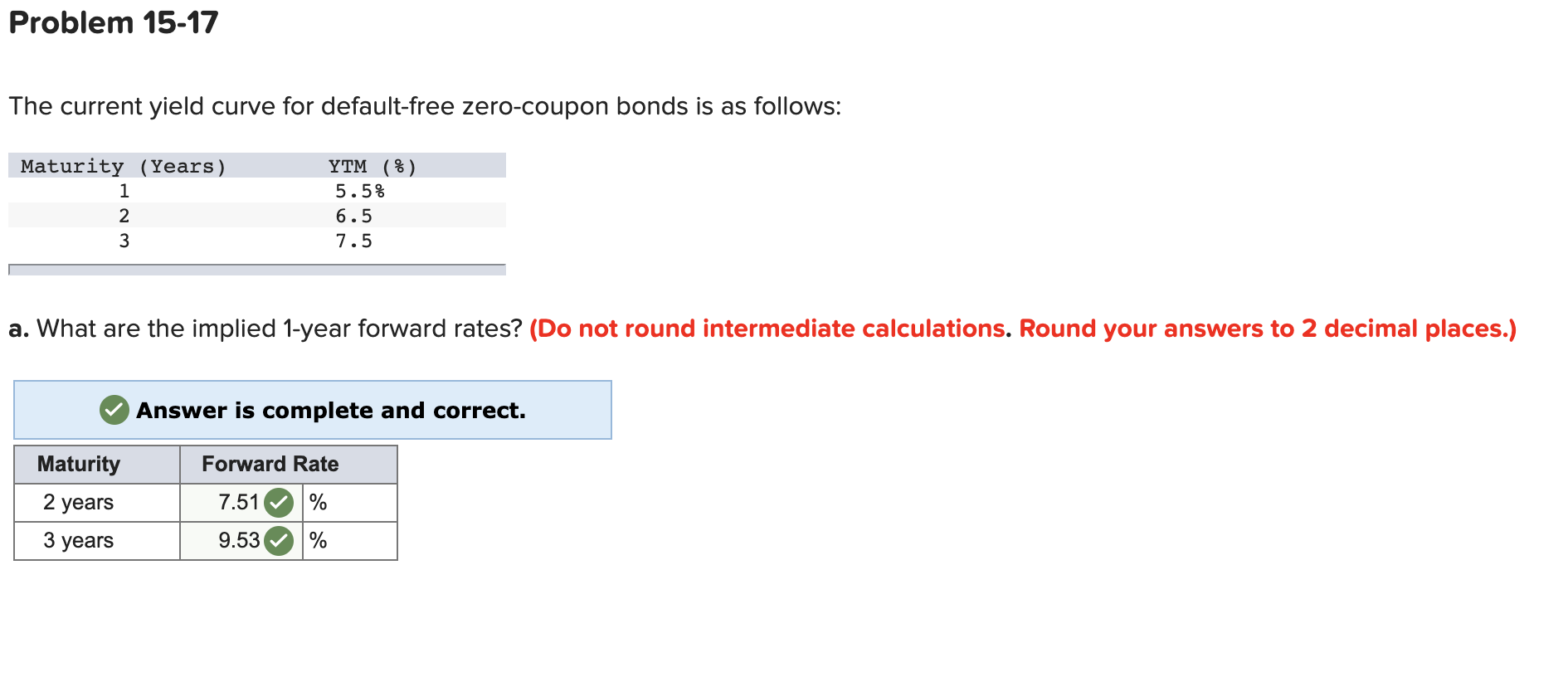

Question : The current yield curve for default-free zero-coupon bonds ... If you purchase a three-year zero-coupon bond now, what is the expected total rate of return over the next year? (Do not round intermediate calculations. Round your answer to the nearest whole percent.) ... YTM = 10%, forward rate is not applicable, short rate = 10% Price = 1000/1+0.1 = 909.09 YTM = 11%, Forward rate = [(1+YTM)^2 / ... › questions-and-answers › the-ytmAnswered: The YTM on a bond is the interest rate… | bartleby Q: Suppose the following bond quotes for IOU Corporation appear in the financial page of today's… Q: Tater and Pepper Corp. reported free cash flows for 2021 of $52.1 million and investment in… A: Free cash flow = $52.1 million Investment in operating capital = $35.1 million Depreciation expenses… How to compute the YTM of a zero coupon bond when price is ... - YouTube How to compute the YTM of a zero coupon bond when price is stated as a percentage of par 440 views Feb 21, 2022 1 Dislike Share Eric Kelley 114 subscribers I start with a zero coupon... 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency - How often the bond makes a coupon payment, per year. If it only pays out at maturity try the zero coupon bond calculator, although the tool can compute the market ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US ... Bond Yield to Maturity (YTM) Calculator - DQYDJ Annual Coupon Rate: 0%; Coupon Frequency: 0x a Year; Price = (Present Value / Face Value) ^ (1/n) - 1 = (1000 / 600) ^ (1 / 3) - 1= 1.6666... ^ (1/3) - 1 = 18.563%. Conclusion and Other Financial Basics Calculators. Use the Yield to Maturity as you would use other measures of valuation: a factor in your decision whether to buy or avoid a bond. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

What Is a Zero-Coupon Bond? - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS...

What is the price of a zero coupon bond with a ytm 4.5%, $1000 par, and ... Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Ye… aslomovitz1125 aslomovitz1125 08/16/2022

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000. Although no coupons are paid periodically, the investor will receive the return upon maturity or upon sell assuming that the rates remain constant. Zero Coupon Bond Effective Yield Formula vs. BEY Formula

› sg › eniShares USD Asia High Yield Bond ETF | O9P - BlackRock Nov 03, 2022 · The iShares USD Asia High Yield Bond ETF seeks to track the investment results of an index composed of USD-denominated high yield bonds issued by Asian governments and Asian-domiciled corporations.

YTM for a zero coupon bond? | Forum | Bionic Turtle so, yeild (YTM) = r = LN (F/P)*1/T; i.e., given the three unknowns, there is only one yield ...and similar logic for discrete frequencies ...Re: "zero coupon bond has just one payment," totally agree

› knowledge › yield-to-call-ytcYield to Call (YTC): Formula and Calculator - Wall Street Prep Dec 31, 2021 · On the date of issuance, the par value of the bond (FV) was $1,000 – but the current bond price (PV) is $980 (“98”). Face Value of Bond (FV): $1,000; Current Bond Price (PV): $980; Bond Quote (% of Par): 98; The final set of assumptions is related to the coupon, in which the bond pays a semi-annual coupon at an annual interest rate of 8%.

YTM for a 0-coupon Bond with <1 year until Maturity : r/bonds For reference, the bond I'm referring to: Face Value: $75,000 Price: $73,620 Purchase Date: 9/15/22 Maturity Date: 3/16/23 . Broker lists the YTM equivalence as 3.66%, which seems right, but I can't get it back out.

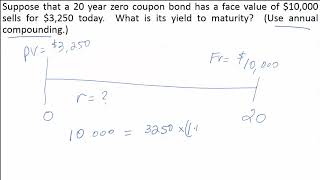

Calculate the YTM of a Zero Coupon Bond - YouTube Calculate the YTM of a Zero Coupon Bond. This video explains how to calculate the yield to maturity (YTM) of a zero coupon bond using the lump sum formula.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero Coupon Bond Ytm - WriteEssaysForMoney.net Question Zero-coupon bond YTM A 12.75-year maturity zero-coupon bond selling at a yield to maturity of 8% (effective annual yield) has convexity of 150.3 and modified duration of 11.81 years. A30-year maturity 6% coupon bond making annual coupon payments also […]

Zero Coupon Bond Calculator - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Ytm Formula For Zero Coupon Bond - thereviewstudio.com Ytm formula for zero coupon bond Your credit score will determine your eligibility. Budget airlines offer low airfares compared to traditional airlines and help passengers save on International Airline Tickets.

ytmZeroCouponBond: Calculates the Yield-To-Maturity(YTM) of a Zero ... The method ytmZeroCouponBond () is developed to compute the Yield-To-Maturity a Zero-Coupon Bond. So, ytmZeroCouponBond () gives the Price of a Zero-Coupon Bond for values passed to its three arguments. Here, maturityVal represents the Maturity Value of the Bond, n is number of years till maturity, and price is Market Price of Zero-Coupon Bond.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox The price of a zero coupon bond is calculated using the YTM formula. If the above formula is rearranged to calculate for the price, then the market price of the bond will be: Present value = ( Face value /(1+YTM)^n) - 1

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Post a Comment for "41 ytm for zero coupon bond"