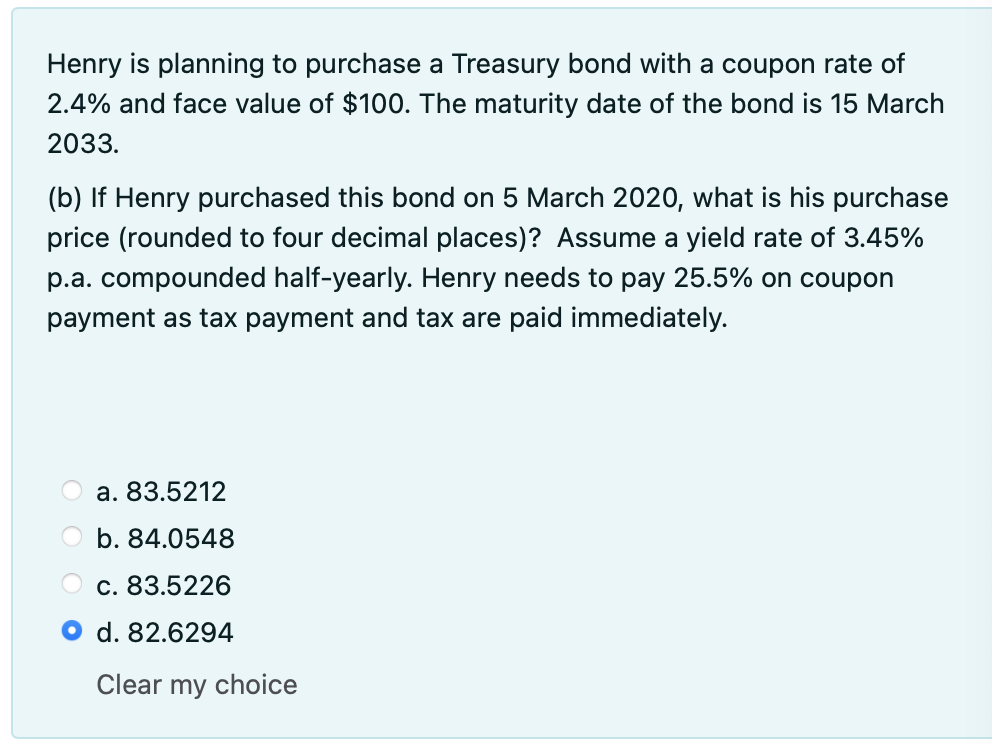

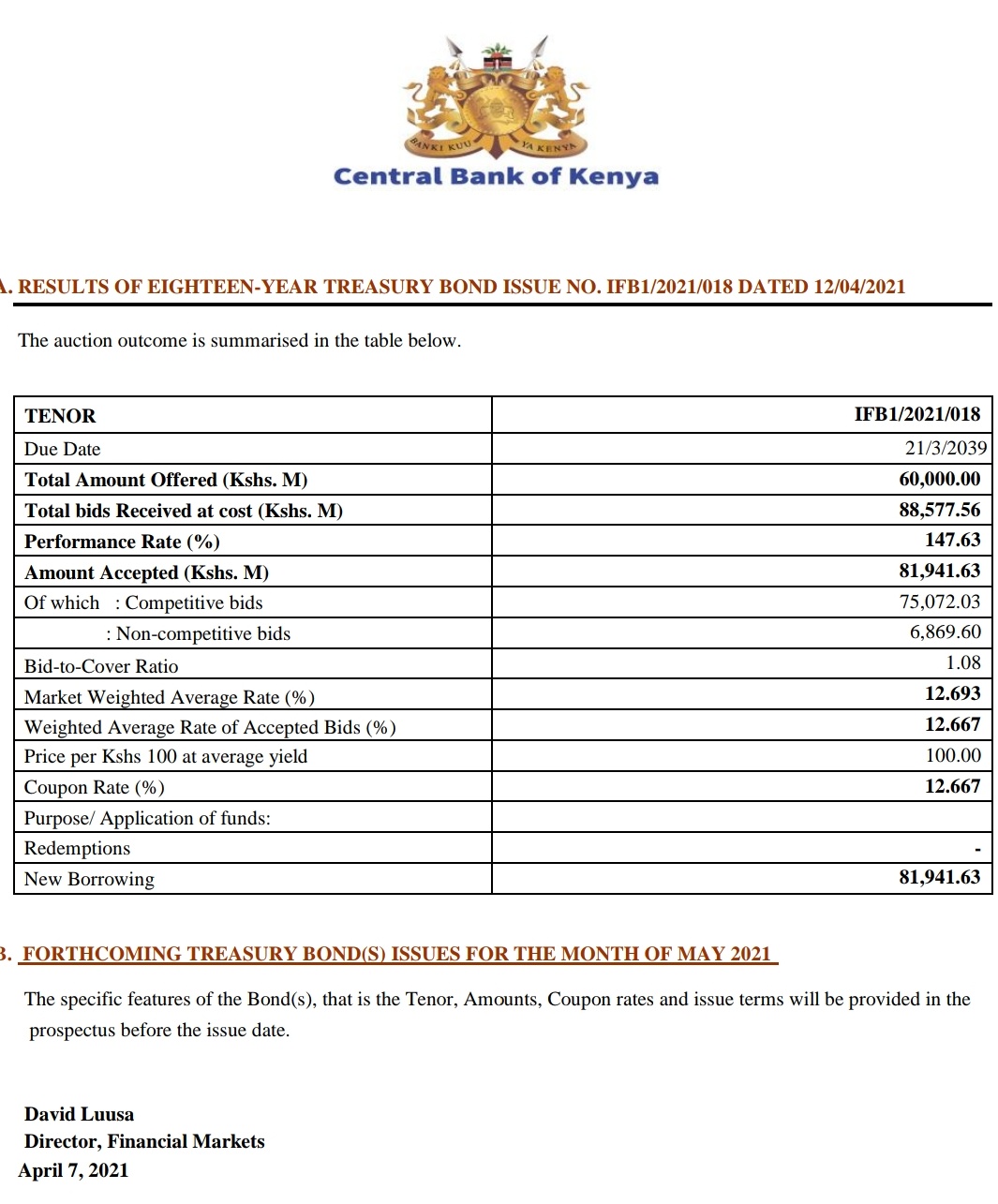

43 coupon rate for treasury bonds

Important Differences Between Coupon and Yield to Maturity - The Balance For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued. United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EST) GB3:GOV . 3 Month .

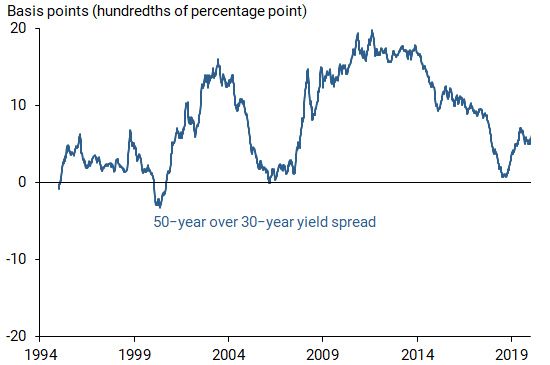

How the Treasury Market Predicts and Influence Interest Rates - The New ... By The New York Times. But Treasury yields began to climb well before the Fed started raising interest rates, signaling the bond market's expectations that the Fed was about to act. Yields on ...

Coupon rate for treasury bonds

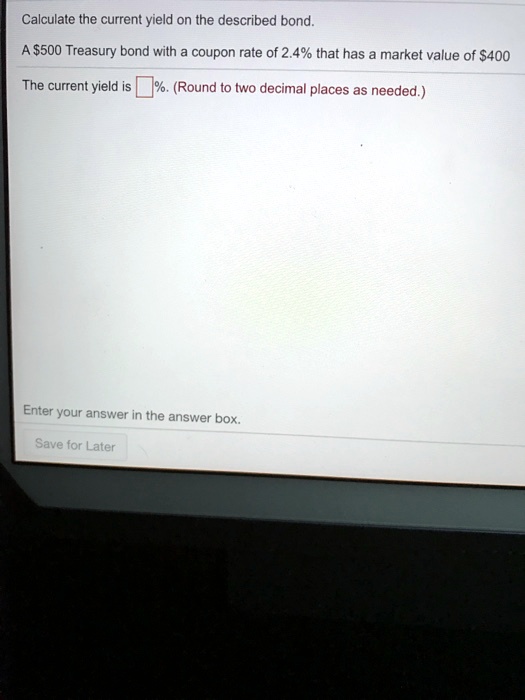

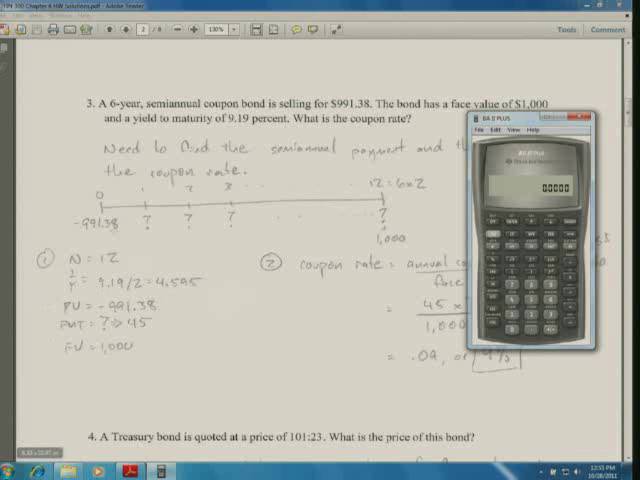

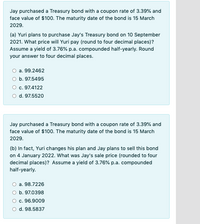

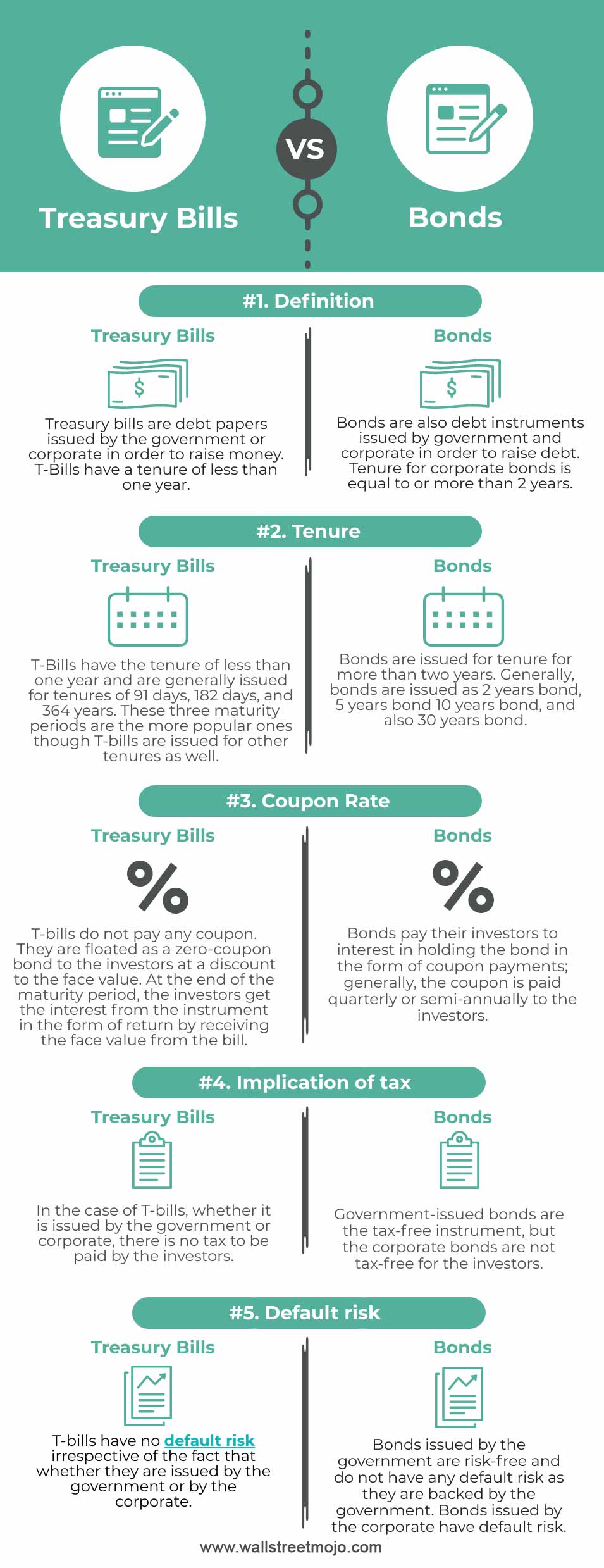

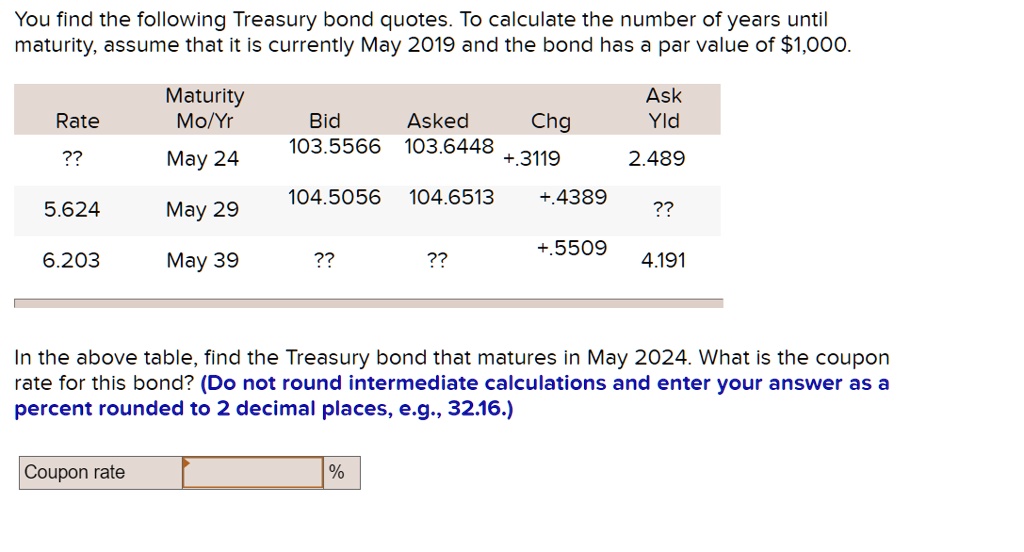

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Who sets the coupon rate for treasury bonds? : r/bonds - Reddit The Federal Reserve sets the coupon rate as the fiscal agent for the Treasury. But there's really no "setting." Whatever is the winning yield at auction, they raise it to the next highest 8th and that becomes the coupon. So if the winning yield is 2.10, the coupon would become 2.125. 2. Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Coupon rate for treasury bonds. What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. I bonds interest rates — TreasuryDirect The composite rate for I bonds issued from November 2022 through April 2023 is 6.89%. Here's how we got that rate: Interest rate changes depend on when we issued the bond Although we announce the new rates in May and November, the date when the rate changes for your bond is every 6 months from the issue date of your bond. How does the U.S. Treasury decide what coupon rate to offer on Treasury ... E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium. If the coupon were set to .5%, it would trade at a huge discount. Par is good, because then the dollar value of the Continue Reading 10 2

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates, etc, Please provide us with an attribution link. How Often do Treasury Bonds Pay Interest? | Fox Business A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the annual coupon ... Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia T-bonds don't carry an interest rate as a certificate of deposit (CDs) would. Instead, a set percent of the face value of the bond is paid out at periodic intervals. This is known as the... Continued Treasury Zero Coupon Spot Rates — TreasuryDirect 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the Selected Asset and Liability Price Report under Spot (Zero Coupon ... Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change.

U.S. Bonds: Treasury yields rise to start the week The policy-sensitive 2-year Treasury yield traded at 4.722%, having risen by seven basis points. It had notched a fresh 15-year high, climbing as high as 4.883%, on Friday.

Treasury Coupons - Macro Economic Trends and Risks - Motley Fool Community Leap1 November 10, 2022, 5:50pm #3. Mark, I found it on the treasury website. It is under the TNC, treasury nominal coupon rate, in table form. Thanks anyway. WendyBG November 10, 2022, 10:32pm #4. The Federal Reserve has data and charts which I use all the time. Google "FRED 10 year Treasury" or any other maturity.

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

What are coupons in treasury bills/bonds? - Quora Treasury bonds and bills have a coupon rate. The coupon rate is the interest rate on the par value of the bond that the bondholder receives annually. Since these securities almost never sell at par, the coupon rate almost never corresponds to the return the investor will receive by Continue Reading Lawrence C.

Coupon Rate Definition - Investopedia For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more...

Understanding Coupon Rate and Yield to Maturity of Bonds The Coupon Rate is the amount that you, as an investor, can expect as income as you hold the bond. The Coupon Rate for each bond is fixed upon issuance. Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name: Coupon Rate: Maturity Date: RTB 03-11: 2.375%: 3/9/2024: Face Value: 1,000,000: Coupon ...

Understanding Pricing and Interest Rates — TreasuryDirect Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes

Treasury Coupon Bonds - Economy Watch The most important advantage of treasury coupon bonds is that they let you create a stable source of income during a given year. The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate. [br]

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate - Forbes With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ...

Coupon Rate of a Bond - WallStreetMojo Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount . Since the coupon (6%) is equal to the market interest (7%), the bond will be traded at par. Since the coupon (6%) is higher than the market interest (5%), the bond will be traded at a premium. Drivers of Coupon Rate of a Bond

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Who sets the coupon rate for treasury bonds? : r/bonds - Reddit The Federal Reserve sets the coupon rate as the fiscal agent for the Treasury. But there's really no "setting." Whatever is the winning yield at auction, they raise it to the next highest 8th and that becomes the coupon. So if the winning yield is 2.10, the coupon would become 2.125. 2.

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Post a Comment for "43 coupon rate for treasury bonds"